Frequently Asked Questions

FAQs

-

We work with individuals, families, and businesses of all sizes across Schenectady and New York’s Capital Region. Our clients range from local entrepreneurs and small business owners to established companies seeking professional CPA services. We also assist out-of-state clients who continue to trust us for their accounting and tax needs.

-

While we provide comprehensive tax preparation, our firm goes far beyond seasonal services. We offer year-round bookkeeping, consulting, payroll assistance, and financial guidance to help clients stay organized and make informed decisions throughout the year—not just during tax season.

-

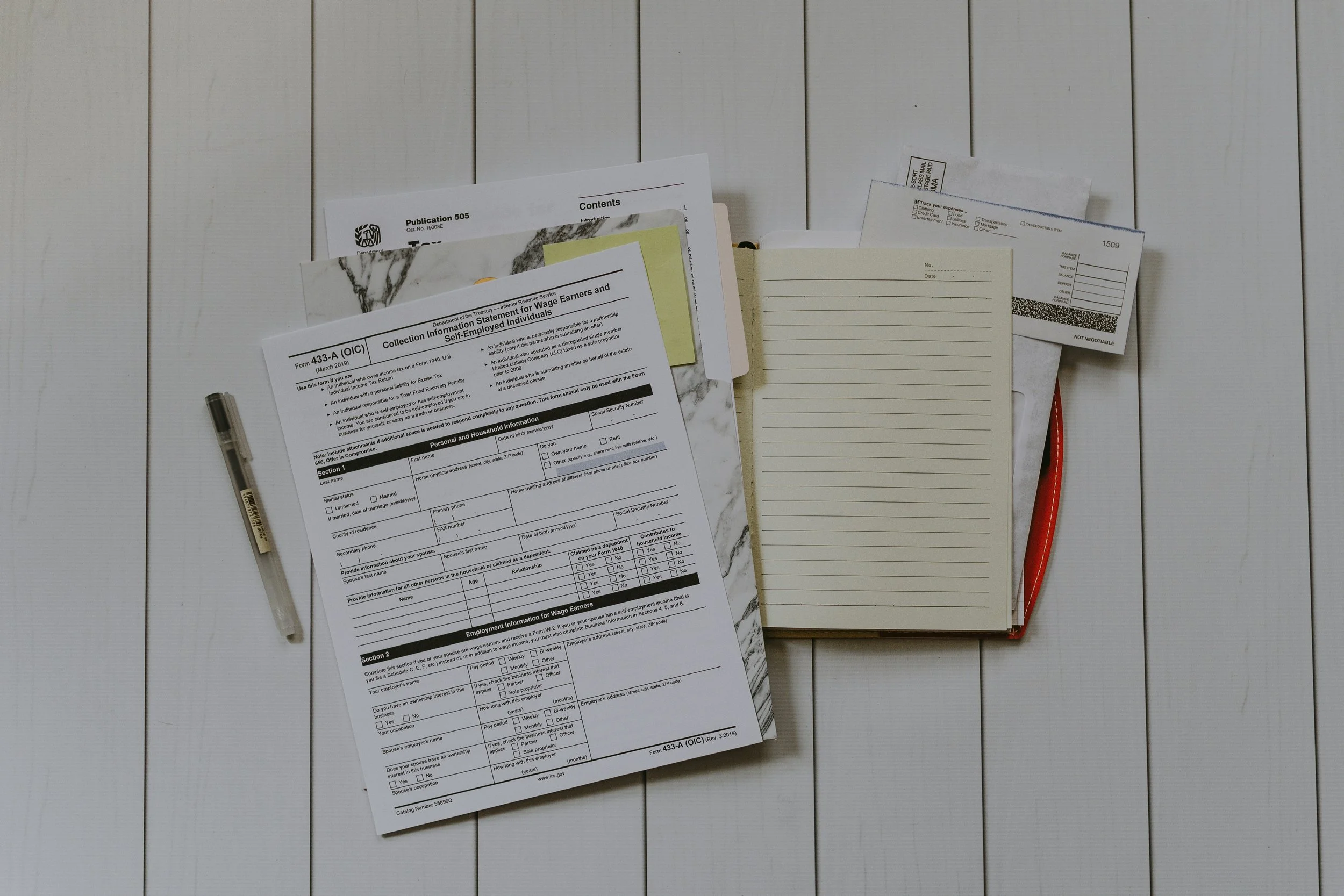

For individuals, bring all W-2s, 1099s, deduction receipts, and prior-year tax returns. Business owners should include income statements, expense records, payroll reports, and documentation for any major purchases or asset changes. Our team will review your documents and ensure you have everything needed before your appointment.

-

A CPA does much more than file taxes. We help small businesses manage cash flow, establish efficient bookkeeping systems, reduce tax liability, and plan for sustainable growth. Working with a CPA ensures that your financial decisions are guided by accurate data and long-term strategy.

-

A Certified Public Accountant (CPA) has passed rigorous state licensing exams and meets ongoing education requirements, ensuring a higher level of expertise and accountability. CPAs can represent clients before the IRS, provide formal financial analysis, and offer strategic tax and business planning services.

-

We use secure digital tools and encrypted communication systems to protect sensitive financial information. Whether you provide documents electronically or in person, your data is always handled with confidentiality and in compliance with professional standards.

-

Yes. We regularly assist clients who need to file back taxes or resolve issues with the IRS or New York State. Our team will review your situation, help bring all filings up to date, and work directly with tax authorities to minimize penalties and find a manageable resolution.

-

Absolutely. Many of our clients work with us remotely through secure file-sharing and online meetings. This allows us to serve both local and out-of-state clients efficiently, providing the same level of service and communication as in-person appointments.

-

Getting started is simple. Call us at 518-346-5100 to schedule a consultation. We’ll discuss your needs, review your current financial setup, and outline how our firm can help. Whether you need year-round accounting support or expert tax preparation, our team is ready to help you move forward with confidence.